Purchasing Event Insurance For The First Time? Follow These Steps!

Before you make concrete plans for your next event, takes some time to think about purchasing event insurance. Sometimes, you may be required to have event insurance by the venue or the vendors and coordinators who you work with over the course of the event planning and execution. Keep the following information in mind when searching for the right insurance and amount of coverage so you can prevent losses and move forward with further plans.

What Type Of Event Insurance Do You Need?

There are quite a few different event insurance companies that offer the two most common needed coverage for events; cancellation and liability. As the names would suggest, cancellation would cover the venue deposits and other associated event costs outlined in the policy due to a covered cause.

Liability will protect the event coordinators and staff named on the policy if there is an accident or injuries sustained during the event. Those are the two most important coverages you 100% need to have for any event. When finding a coverage that works for you, make sure to read the fine print. A lot of the times things you need covered like liquor, lawsuits, injury are all covered under liability.

Here are a few other important coverages you may want to have:

Special Event Insurance (one-day event insurance, usually includes cancellation and liability)

Liquor Liability

Property Damage

Weather

Location Damage

Finding Event Insurance Providers

One of the first steps you need to take when securing event insurance is outlining your needs. Determine which types of event insurance/coverage you will require and then begin the process of finding insurance providers who can adequately handle your individual situation.

You can ask other professionals in your field who they recommend to get started. There are some instances where the venue can provide your event insurance, but it may be optional and leave you the choice to find another company.

Some top event insurance providers to scout include:

When Should You Purchase Event Insurance?

Event insurance should be purchased prior to reserving your venue (check to see if the venue already has coverage) or hiring any vendors or entertainment; basically before you start booking and putting down deposits. It should be one of the first steps you take during the planning process.

You will need information about the venue location and dates as well as logistical information to get started so make sure you have all of your plans outlined to present to the company. They may request additional confirmation and receipts to finalize the policy so file all your paperwork correctly. Always keep track of all of your correspondence and submitted documentation in the event you need to file a claim.

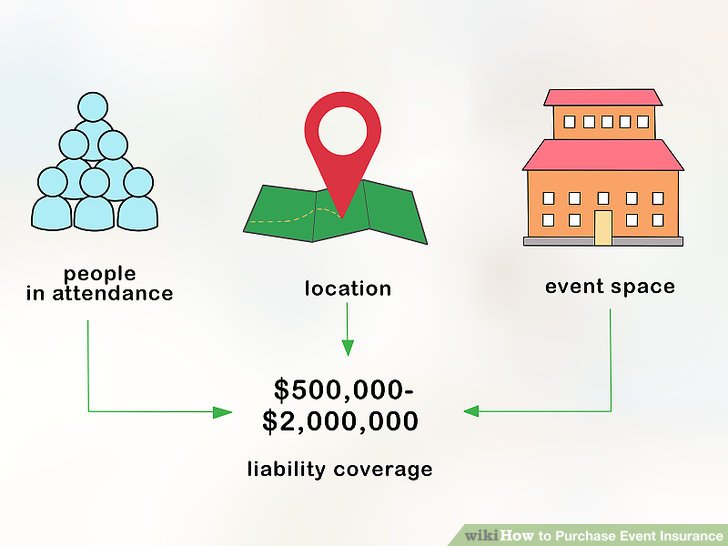

What Protection Does Event Insurance Offer?

Event Insurance is the best way to protect yourself from a variety of risks and liability and is actually affordable and widely available according to The Balance Small Business.

Some risks that you can provide protection from include injuries, property damage, alcohol related incidents, weather, bodily injury and cancellations. To get a complete list of covered events, make sure to read your policy’s terms and conditions and consult with your agent to get a verbal breakdown of the contract before making a purchase so everyone is on the same page. If you feel that there may be the need to increase your insurance coverage or purchase additional policy protection due to unusual circumstance, you should notify your provider and get a list of options to prevent gaps in coverage.

If you are planning an event, you should begin your search for event insurance to help protect your organizers and attendees ASAP. Insurance is one of the key tools to prevent losses and ensure everyone is protected from the unexpected. If you would like to learn more about event planning essentials, you can subscribe to our blog below.